To Our Success!

We were honored to have sponsored again the 11th Annual We Heart Maggie golf tournament at The Revere Golf Club on May 25th. All proceeds went to the Children’s Heart Foundation.

Our Locations

Our Locations

To Our Success!

We were honored to have sponsored again the 11th Annual We Heart Maggie golf tournament at The Revere Golf Club on May 25th. All proceeds went to the Children’s Heart Foundation.

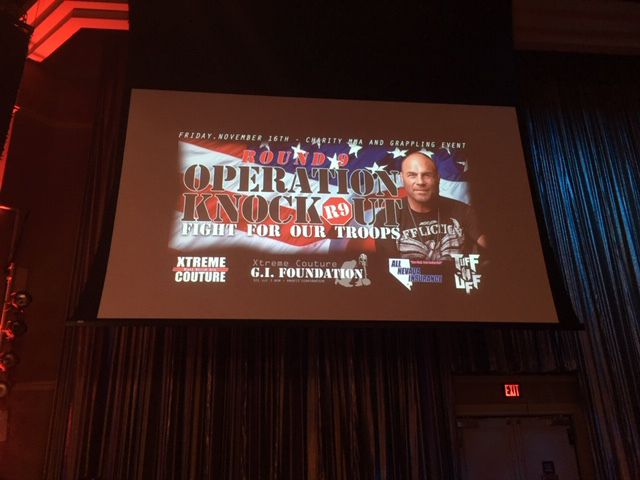

On November 16, 2018, we raised $56,000 for Randy Couture’s GI Foundation, which directly benefits wounded soldiers and their families! This is the most money raised to date! We hope to raise even more next year!

If you’re thinking of becoming your own boss, investing in a franchise business is one popular option that may be worth looking into. After all, you’re investing in an already-established business with a higher risk of success than owning your own business.

Before you get started on the documents, be sure that you know these essential factors first.

The Franchise Model

It’s been labeled as the greatest business model ever invented and has enabled hundreds of thousands of people to own their own business successfully. As a franchisee, you buy into a franchise, such as a service or product, and run it as if it were your own. With a complete model, training, and support, you cut out a lot of the startup mistakes.

Risk

Investing in a business, franchise or not, is risky. While there’s no way to mitigate your risk, there are ways to lower it. One of this is to research the franchise company thoroughly before signing on the dotted line. It sounds simple enough, but it’s a step commonly overlooked. Check out the benefits of becoming a franchisee and be sure you know how to choose the right franchise.

Rules

With anything in life, there are guidelines. Franchising is not a free for all. Similarly, it’s not for everyone. Before you commit to becoming a franchise owner, make sure that you understand the rules. All franchises have them, and need them! Rules maintain consistency of the products, the services, and the brand.

Finances

Most franchises have a minimum net worth requirement for franchisee, so be sure that you know yours (and that it meets the minimum requirements!). Start by adding up your assets and then your liabilities. The difference between the two is your net worth.

Take your time to assess your needs, wants, and find the right fit for you. It’s a venture that should be enjoyed by handled carefully.

Are you ready to find the right franchise opportunity? Visit All Nevada Insurance today for more information!

Many start-ups and small businesses are unsure about whether they need insurance, and if they do, what kind. While most storefronts know that they need insurance coverage, the uncertainty comes when a business is only online. Whether you offer services online or run an online store, it’s wise to have the right insurance in place. Take a look at the types of coverage you may need.

This coverage can protect your business against third-party personal injury and property damage claims, as well as advertising injuries.

Often known as Errors and Omissions insurance, this policy has you covered if you make a mistake in rendering your professional service. If you regularly do outside work with contractors, it’s also a good idea to ensure they have their own E&O policy. This way, if a contractor makes a mistake, their policy should be able to cover any resulting legal expenses.

Cybercrime is on the rise and data breaches can happen to any business, large or small. If a project you work on results in customer data being stolen, you could be looking at a substantial lawsuit.

Believe it or not, but even if you work from home, your homeowners insurance may not cover your business equipment. Protect your laptop, computer, hard drive, and entire office with property insurance that specifically covers your business property.

Even though your business is online, you may be constantly on the move. If your business has you driving all over the place, consider securing commercial auto insurance. This will protect you when you’re out and about on business-related errands.

Get the right insurance for your business in place. Contact the team at All Nevada Insurance to get started.

After a car accident, however minor, it’s important to call the police and file an official police report. Although you may be more concerned about calling your insurer and filing a claim immediately, calling the police out to the accident scene can help to progress your claim than if you were to proceed without a police report.

When to File a Police Report

You should contact the police anytime you have a car accident. Even if you think the crash was fairly minor and no one is hurt, it is best to contact the police and let them decide if they will come to the scene. Sometimes there is more physical and medical damage later that is not always apparent at the time of the car accident, too. Having a police report on file will help to prove that the accident happened.

Why a Police Report is Important

In addition to providing documentation of the accident, the police report indicates an unbiased third-party report of the incident. This can be more effective as evidence than either driver telling their side of the story. Insurance companies will need the police report, and it will help your claim.

If you are the at-fault driver, it is still equally important to have a police report. In the event the other driver tries to fake an accident, having a police report on file can save you from becoming responsible for a fake injury.

Getting in Contact with the Police After the Accident

After the accident report is filed, make sure you get a card or direct contact information from the police officer who filed the accident report. Often after an accident, you may only remember additional details later and these details could be very important, especially if the car accident ends up in a lawsuit.

When you’re looking to protect your vehicle and finances, car insurance can help. Contact All Nevada Insurance to get started on the right policy to suit your needs, budget, and car!

Many entrepreneurs dream of building a company from scratch. But for many aspiring business owners, a start-up isn’t a realistic goal. With competition, high costs, and a large learning curve, more often than not, purchasing a franchise is a less risky path to success.

Check out some of the major advantages of buying a franchise over an independent business.

Brand Recognition

In the world of startups and small businesses, it’s ideal to step into a company that is already established. The hard work is already done for you: the outreach, the promoting, and there is already brand recognition. While different franchises certainly have different levels of awareness, owners can at least be confident that the product or service has been successful elsewhere.

Operating Systems

One advantage of buying a franchise is that the business has an established client base, operating history, and solid business plan. Franchises will have gone through rigorous procedures, giving new owners a well-thought out, stable operating system. New owners can avoid the mistakes that have already been resolved upon starting up.

Continuous Support

Another great reason to purchase a franchise opportunity is the availability of a support team. The franchisors share a concern for your success and will put systems in place to help you succeed. They will provide training for you and your team, and help you with questions that arise. Especially for first-time business owners, it can be very reassuring to know that someone is there to help over every hurdle.

Where there are risks in any new business venture, purchasing a franchise limits some of the concerns independent businesses carry.

Once you’ve decided to become a franchise business owner, check out All Nevada Insurance’s franchise opportunity. Find out more information by giving us a call today!

Being a homeowner means taking on new responsibilities. From the home’s structure to the HVAC systems, maintenance and upkeep is all down to you. To keep your valuable asset in good condition, be sure you’re doing these crucial (but often overlooked) maintenance tasks.

Clean the lint from around your clothes dryer regularly. By around it, we mean under it, on top of it, behind it, and beside it. It’s also a good idea to take off the hose and remove the build-up of lint from inside there. This should be done at least twice a year, if not more often.

Have your home inspected for termites annually. Termites can wreak havoc on your home’s structure and your wallet. This is especially true since most standard home insurance policies don’t cover termite damage. If your home does have termites, it’s best to resolve the issue quickly.

Install smoke and carbon monoxide detectors. The easiest way to prevent or stop a fire is by purchasing smoke and carbon monoxide detectors. Fit fire alarms on every level of the home and outside each sleeping area. A carbon monoxide detector should also be located on every floor of your home, including one near the garage. Test these alarms monthly, refreshing the batteries if needed.

Remember, another great way to protect your home with homeowners insurance. Talk to the professionals at All Nevada Insurance to secure the right homeowners insurance for your needs in Las Vegas, Nevada.

Entrepreneurs, from an unemployed person striking it out on their own to seasoned veterans trying again, must do things differently in order to survive. Even small business owners need to keep up with the latest trends, market, and stay on top of their finances. While ensuring a successful business is no small feat, there are ways to help keep it going through tough times and financial weak spots. Here are a few tips to keep your small enterprise out of the red.

Before attacking business debt, get a handle on your current financial situation. Revisit your financial plan and adjust for unexpected changes in cash flow. Whether you work with professionals or use accounting software, tracking money flowing in and out of your business will help you to grasp a better understanding of what you need to adjust.

If a once-successful business is beginning to struggle, it is almost always a people-related issue. It is likely that somewhere along the way something broke and now there is a disconnect between the owner’s concept and what people did with the concept. If you need to, retrain your team, improve policies, and assess how to improve customer engagement and experience.

If you want to keep your business turning a profit successfully, it will need to meet current demands of the time. Thoroughly evaluate the marketplace of the proposed business including the competition, demand, and needs of the market. This can help you to assess the potential investment returns ensuring that you know when the proprietorship is likely to remain viable.

Find financial stability by securing reliable and affordable insurance policies. Contact the team at All Nevada Insurance for information on how to select adequate coverage for your needs.

All prospective franchisees have one thing in common: curiosity. They’re all curious about income – and for good reason. They all want to know how much they’re going to make so that they can determine if it is worth it. After all, if they are going to be investing their own money, they should be able to predict their salary range.

If you’re looking to become the owner of a franchise, it’s important that you know some basics first. One of them is your salary. It’s worth noting that there is no one solid figure that franchise owners can rely on. It all depends on the industry, how many hours you put into the business, what your lifestyle is like, among others.

Firstly, it’s important to determine if franchising is for you. It’s wise not to base your next career solely on a potential salary, so look for a franchise that inspires you, motivates you, and one that you are truly passionate about. If you dislike the industry, you’re likely to dislike the franchising ownership.

If you’re looking at becoming the owner of a start-up franchise business, you may not have a salary coming in during the beginning stages of your new business. You may have just invested some of your own money into a brand-new business, may have got a small business loan to cover the balance of the total franchise costs, and you may not have any customers for the first couple of weeks. That is why it is so important to go into franchising with the right company. They will be able to give you the help that you need to get up and running quickly and effectively, meaning that you can have business in no time!

When you do open up the franchise, you’ll certainly have money coming in. But even so, it may not be able to go into your pocket – it should go back into the business. You’ll have expenses to cover such as rent, inventory, advertising, and utilities. Your goal needs to be breaking even. It’s at that point in which your revenue pays your business expenses.

Talk to the franchising business, as they may be able to tell you how much you’ll make as a franchise owner. Finding information out has to do with income, and other pertinent information regarding the operation of the business needs to be part of your franchise research. Only then will you have the whole picture!

To get started on the right franchise for your needs, visit the team at All Nevada Insurance for an exciting franchise opportunity!

Working from home certainly has its benefits: you avoid a commute, you have the freedom to run errands when you need to, and digital tools make it simple to check in with your colleagues. Even so, there are quite a few challenges, too. Being distracted by domestic duties, friends, and family can result in your work suffering. To master the art of working from home successfully, read on.

Establish working hours.

This is the first step to ensuring productivity while working from home. If your employer hasn’t set you hours already, do so for yourself. It’s tempting to give yourself flexibility by sleeping in or taking frequent breaks, but this can only lead to unproductivity in the long run. Set yourself consistent hours to stay accountable to yourself and to your boss.

Identify what needs to get done every day.

You may think you’re less accountable for the work you do when you work from home, but in reality, you should be ensuring all deadlines are met and your work is up to standard because there really is no excuse. By noting what you need to do each day, you give yourself tasks that you need to complete, whether you’re distracted or not.

Get dressed.

It’s tempting to work in your pajamas and slippers, but this could hinder your work. Keep to a regular routine of waking up, showering, and getting dressed – just as you would if you were going to an office. This helps to flip a switch in your brain that you’re in work mode so that you focus on getting your work done.

Create an at-home office.

Sure, the couch is comfier to do work, but this could take a huge toll on your productivity. Just like getting dressed, working from a desk tells your brain that it’s time for work, not relaxation. You are more likely to feel alert and organized if you work at a desk, even if it’s the kitchen table.

Stay in the loop.

Remote workers lose the opportunity to pop into someone’s office, so they need to be mindful to do so virtually. Checking in with your team may mean more deliberate and responsive emails, sometimes supplemented by instant messaging. It’s a good way to let your team know you’re working from home.

Whether you’re looking for business insurance for your endeavor or you’re looking for a new opportunity to start a franchise, contact the team at All Nevada Insurance today.